Getting The Estate Planning Attorney To Work

Getting The Estate Planning Attorney To Work

Blog Article

The Ultimate Guide To Estate Planning Attorney

Table of ContentsSome Known Factual Statements About Estate Planning Attorney Estate Planning Attorney - An OverviewIndicators on Estate Planning Attorney You Need To Know

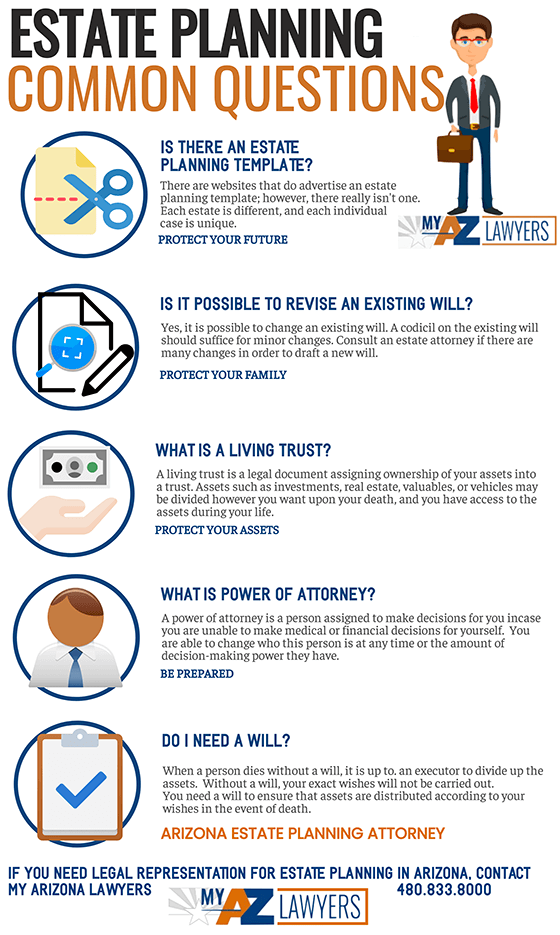

The different fees and costs for an estate strategy should be gone over with your attorney. There are numerous sources for estate planning used on the web or by different organizations, and the reward to avoid lawyers' costs is usually a motivating variable.

It is likewise possible that it will certainly be transformed as a result of the change of management in 2020. The Illinois estate tax limit quantity is $4,000,000 and an estate with also $1 over that quantity is subject to tax on the whole amount. An individual whose estate exceeds these exception or threshold degrees needs to do some additional estate planning to lessen or eliminate death taxes.

The Illinois estate tax threshold is not portable. Normally, a present of property from a person to his/her spouse who is an U.S. resident is not subject to a present tax or an estate tax. Presents to anyone else is a taxed gift, however goes through a yearly exclusion (gone over listed below) and the very same lifetime exception when it comes to federal inheritance tax.

What Does Estate Planning Attorney Mean?

Some estate plans may consist of life time gifts. In 2020, an individual can give up to $15,000 a year to anybody without a gift tax obligation. On top of that, under certain conditions, an individual could make presents for clinical costs and tuition costs above the $15,000 a year limit if the clinical payments and tuition settlements were made straight to the clinical supplier or the education company.

Couples typically have homes and checking account in joint occupancy. It is made use of much less regularly with nonspouses for a variety of factors. Each joint lessee, no matter which one purchased or originally had the building, can use the jointly owned building. When two people very own building in joint occupancy and among them dies, the survivor comes to be the 100 percent proprietor of that property and the deceased joint occupant's passion terminates.

There is no right of survivorship with tenants-incommon. When a tenant-in-common passes away, his/her rate of interest passes to his/her estate and not to the enduring co-tenant. The building passes, rather, as part of the estate to the heirs, or the recipients under a will. Occupancy by the totality enables spouses to hold their key home devoid of insurance claims versus just one spouse.

The Estate Planning Attorney Diaries

At the death of the proprietor, the assets in the account are transferred to the assigned beneficiary. Illinois has just recently embraced a law that enables specific actual estate to be transferred on death a fantastic read through a transfer on death tool.

The recipient of the transfer on death instrument has no passion in the realty until the death of the owner. All joint tenants have to agree to the sale or mortgage of the residential or commercial property. Any type of one joint occupant may take out all or a component of the pop over here funds in a joint checking account.

Estate, present, or income tax obligations may be affected. Joint occupancy might have various other consequences. : (1) if residential or commercial property of any kind of kind is held in joint tenancy with a relative who obtains well-being or other advantages (such as social security advantages) the relative's privilege to these benefits may be threatened; (2) if you place your residence in joint occupancy, you might shed your right to beneficial elderly person real estate tax therapy; and (3) if you develop a joint tenancy with a youngster (or anyone else) the youngster's financial institutions might seek to gather your youngster's debt from the home or from the earnings of a judicial sale.

Nevertheless, joint occupancies are not a straightforward remedy to estate troubles however can, in reality, develop troubles where none existed. The costs of preparing a will, tax planning, and probate may be of little value compared with the unexpected issues that can occur from using joint occupancies indiscriminately. For a complete explanation of the advantages and drawbacks of joint occupancy in your particular scenario, you should consult a legal representative

Report this page